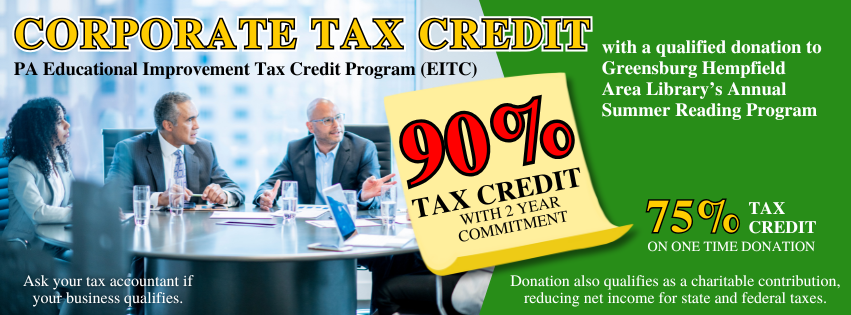

Corporate Tax Credit through Educational Improvement Tax Credit program

What is EITC?

The Educational Improvement Tax Credit (EITC) program provides tax credits to eligible, corporate tax-paying businesses in PA when they donate to an approved Educational Improvement Organization (EIO) like Greensburg Hempfield Area Library. GHAL has gone through the official process of applying for and being granted eligibility to receive EITC funds.

PLEASE NOTE! Both the donating business and educational organization must apply for and be approved in the program. Contact your tax accountant to see if your business qualifies BEFORE you begin applying.

Eligible businesses can receive a tax credit equal to 90% of your contribution for a two year commitment, and a 75% credit for a one year commitment. Also, your donation qualifies as a charitable contribution, reducing the business’ net income for state and federal taxes.

What businesses are eligible?

Businesses authorized to do business in Pennsylvania who are subject to one or more of the following taxes:

- Personal Income Tax

- Capital Stock/Foreign Franchise Tax

- Corporate Net Income Tax

- Bank Shares Tax

- Title Insurance & Trust Company Shares Tax

- Insurance Premium Tax (excluding surplus lines, unauthorized, domestic/foreign marine)

- Mutual Thrift Tax

- Malt Beverage Tax

- Retaliatory Fees under section 212 of the Insurance Company Law of 1921

Tax credits may be applied against the tax liability of a business for the tax year in which the contribution was made.

How do I apply?

Pennsylvania businesses can begin applying for EITC credits through the Department of Commerce’s Department of Community and Economic Development’s (DCED) electronic application system https://dced.pa.gov/programs/educational-improvement-tax-credit-program-eitc/ on July 1.

The business application guide on that site explains the process of applying. Tax credit applications are processed on a first-come, first-served basis by day submitted. Applications will be approved until the amount of available tax credits is exhausted.

How do I receive my tax credit?

Step 1: After submitting your application AND upon receipt of acceptance letter, mail your donation check to:

Greensburg Hempfield Area Library

237 S Pennsylvania Avenue

Greensburg, PA 15601

* Include “EITC donation” on memo line

Step 2: To receive tax credit, submit the gift acknowledgement letter you will receive back from GHAL once your donation is processed to:

Department of Commerce & Economic Development

Commonwealth Keystone Building

400 North Street, 4th Floor

Harrisburg, PA 17120-0225

Questions? Call (800) 379-7448 or email era-dcedcs@pa.gov

What are the approved programs at GHAL that I can fund?

By donating to GHAL as an approved EITC program participant, your business affords children in GHAL’s service area more opportunities for broader educational opportunities by helping to fund the annual Summer Reading program. With your participation, you will be directing your tax dollars to benefit education that

- sustains knowledge retention between the end of one school year and the start of a new one for school-age children by challenging them to read, participate in educational programs, and complete complementary activities

- furthers early literacy initiatives to prepare pre-school aged children for formal education

- supports parents and legal guardians of children of all ages with their care as it relates to educational milestones and development with educational resources and services

- assists children with disabilities and their caregivers by providing access to resources and contacts for support, advocacy, and information

For more information or to direct your donation, contact jamie.falo@wclibraries.org, Library Director, or by phone at 724-837-5620.